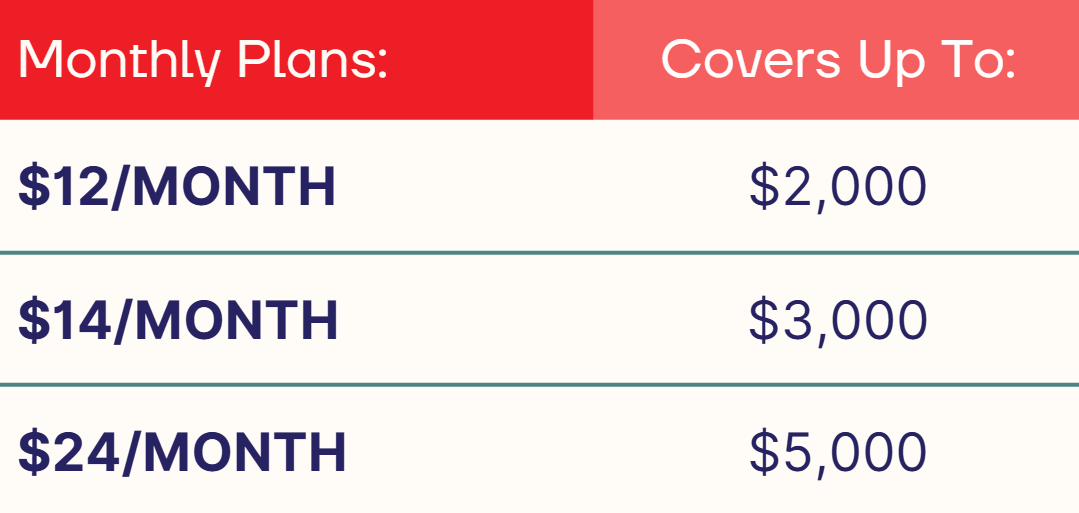

Enrolling in our Protection Plan is quick and easy. You can opt in during move-in or add it to your account at any time. Just let your site manager know, and we’ll take care of the rest. Plans start at just $12/month for $2,000 of coverage, with higher coverage limits available. (up to $5,000). Once enrolled, your protection takes effect immediately and renews monthly with your rent.

Protection Plan vs. Insurance Coverage: All You Need to Know

Worry Less with the Right Coverage for Your Unit

PROTECTION PLAN VS. INSURANCE POLICIES

It’s important to understand that our Protection Plan is not an insurance policy—it's a limited waiver of our liability for covered losses. While it functions similarly to insurance, it’s designed specifically for our facility and offers fast, direct support in the event of a claim. Traditional insurance may involve longer wait times, higher deductibles, or no coverage for offsite storage at all. Our plan keeps it simple, affordable, and tailored to your needs.

WHY IT'S REQUIRED

To ensure all customers are protected against unexpected losses, we require that every storage unit have some form of coverage. American Self Storage does not insure your belongings—this is a standard in the self-storage industry. Your stored items remain your sole responsibility, and in the event of damage, theft, or loss, you must have insurance or a protection plan in place. Requiring coverage is not just for our protection—it’s for yours, giving you peace of mind knowing your items are backed by a safety net.

WHY OUR PROTECTION PLAN IS RECCOMENDED

Homeowners and renters insurance policies often do not cover items stored offsite, or they may have very limited protection with high deductibles. Our Protection Plan is specifically designed for storage unit risks and tailored to our facility's setup. It offers a convenient, affordable, and effective way to safeguard your stored belongings—without requiring you to go through a third-party insurer. It also simplifies the claims process, helping us resolve issues faster for you.

OUR PROTECTION PLAN OPTIONS

WHAT OUR PLAN COVERS

Our Protection Plan offers reimbursement for certain damages or losses to your stored items up to your selected limit (starting at $2,000). It includes losses resulting from covered events such as fire, smoke, water damage, theft (with signs of forced entry), and vandalism—as long as these occur due to negligence or circumstances within our legal responsibility. There’s no deductible for most claims, unless a proper disc or cylinder lock was not used in the case of theft.

WHAT HAPPENS WHEN YOU DON'T PROVIDE PROOF OF INSURANCE

If proof of third-party insurance is not provided at move-in or during your rental period, we may automatically enroll you in our Protection Plan to ensure your items are covered. This ensures compliance with our rental agreement and helps protect both you and our facility in case of unexpected events. If you'd rather use your own insurance, simply provide proof of coverage and we’ll remove the plan from your account.

NO COVERAGE WITHOUT ACTIVE PAYMENT

To stay covered under the Protection Plan, your monthly payment must be current. If you miss a payment, your coverage is suspended, and any loss or damage during that unpaid period may not be eligible for reimbursement. Reinstatement may be possible after catching up on rent, but no claims can be filed for gaps in coverage.